How is EV Road Tax Calculated?

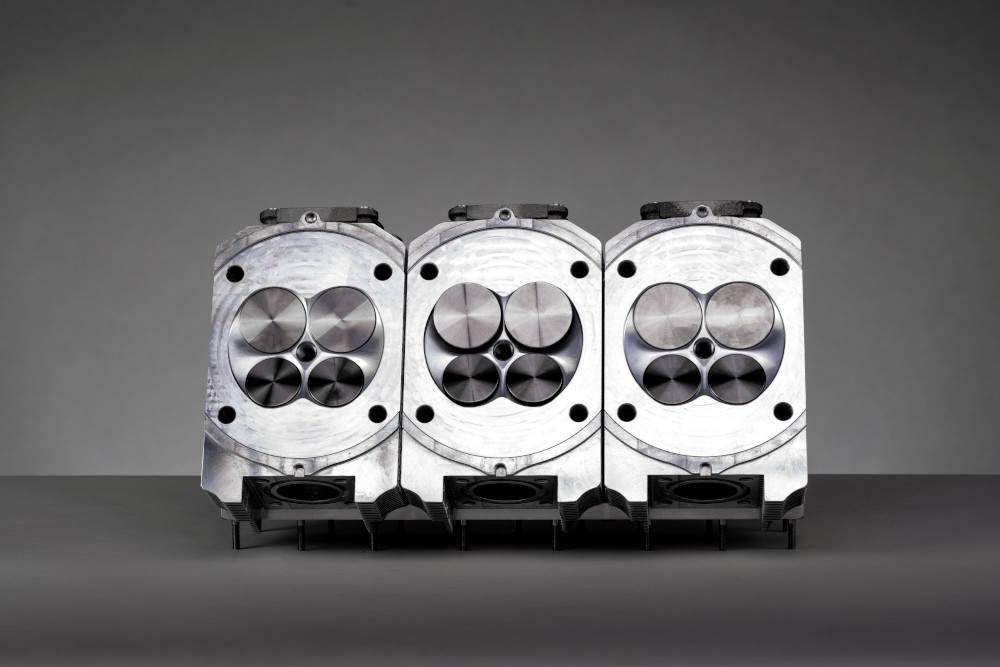

Paying road tax is something we’ve become accustomed to as ICE vehicle owners. How much you pay depends on the engine capacity, which is measured in cc also known as cubic capacity. In a nutshell, it means how much fuel and air can fit into the cylinders of said engine.

The Malaysian Road Transport Department or JPJ decides road tax based on this engine capacity. This is calculated according to the defined rates. The higher the capacity the more expensive the road tax you will need to pay annually. However, those same calculations will not translate when it comes to EVs because they have no cylinders to speak of.

In the case of electric vehicles, the road tax is calculated based on the maximum output of the electric motor. The rates and how they are calculated have been around for some time. And though these rates might be revised in the current weeks to encourage more EV adoption, let’s stick to what’s already set in stone.

For now, all EV owners are exempted from paying any form of road tax for their electric vehicles until the end of next year. On 1st January 2026, if no further incentives are provided, they will need to start paying, annually, just like owners of ICE vehicles.

But how is this calculated?

Based on the rates provided by JPJ:

For private or company owned Saloon EVs

| Motor Power | Rate |

| 50kW and under | RM20.00 |

| Above 50kW to 60kW | RM44.00 |

| Above 60kW to 70kW | RM56.00 |

| Above 70kW to 80kW | RM72.00 |

Road tax for EVs with electric motors that are above 80kW are calculated based on a progressive rate that’s added onto the base rate.

| Motor Power | Base Rate | Progressive Rate |

| Above 80kW to 90kW | RM160.00 | RM0.32 for every 0.05kW increase from 80kW |

| Above 90kW to 100kW | RM224.00 | RM0.25 for every 0.05kW increase from 90kW |

| Above 100kW to 125kW | RM274.00 | RM0.50 for every 0.05kW increase from 100kW |

| Above 125kW to 150kW | RM524.00 | RM1.00 for every 0.05kW increase from RM125kW |

| Above 150kW | RM1,024.00 | RM1.35 for every 0.05kW increase from 150kW |

For private or company owned EVs other than saloons

| Motor Power | Rate |

| 50kW and under | RM20.00 |

| Above 50kW to 60kW | RM42.50 |

| Above 60kW to 70kW | RM50.00 |

| Above 70kW to 80kW | RM60.00 |

Road tax for EVs with electric motors that are above 80kW are calculated based on a progressive rate that’s added onto the base rate.

| Motor Power | Base Rate | Progressive Rate |

| Above 80kW to 90kW | RM165.00 | RM0.17 for every 0.05kW increase from 80kW |

| Above 90kW to 100kW | RM199.00 | RM0.22 for every 0.05kW increase from 90kW |

| Above 100kW to 125kW | RM243.00 | RM0.44 for every 0.05kW increase from 100kW |

| Above 125kW to 150kW | RM463.00 | RM0.88 for every 0.05kW increase from 125kW |

| Above 150kW | RM903.00 | RM1.20 for every 0.05kW increase from 150kW |

For example, a BYD Dolphin Extended with a 150kW electric motor will have a road tax of RM903.00. But how is this calculated?

It’s a hatchback and therefore falls under the non-saloon category.

The base rate is RM463.00 as the motor power is between 125kW and 150kW. Then this figure needs to be added to the progressive rate.

Progressive rate:

150kW – 125kW = 25kW

RM0.88 for every 0.05kW increase from 125kW,

25kW/0.05kW = 500

Total for progressive rate:

RM0.88 x 500 = RM440

Total road tax due:

RM463.00 + RM440 = RM903.00

Reference: Road Tax Rate Guidelines by JPJ